what is the salt deduction repeal

The Committee for a Responsible Federal Budget described the repeal of the SALT cap as a regressive tax cut estimating that it would cost 90 billion a. Nov 19 2021.

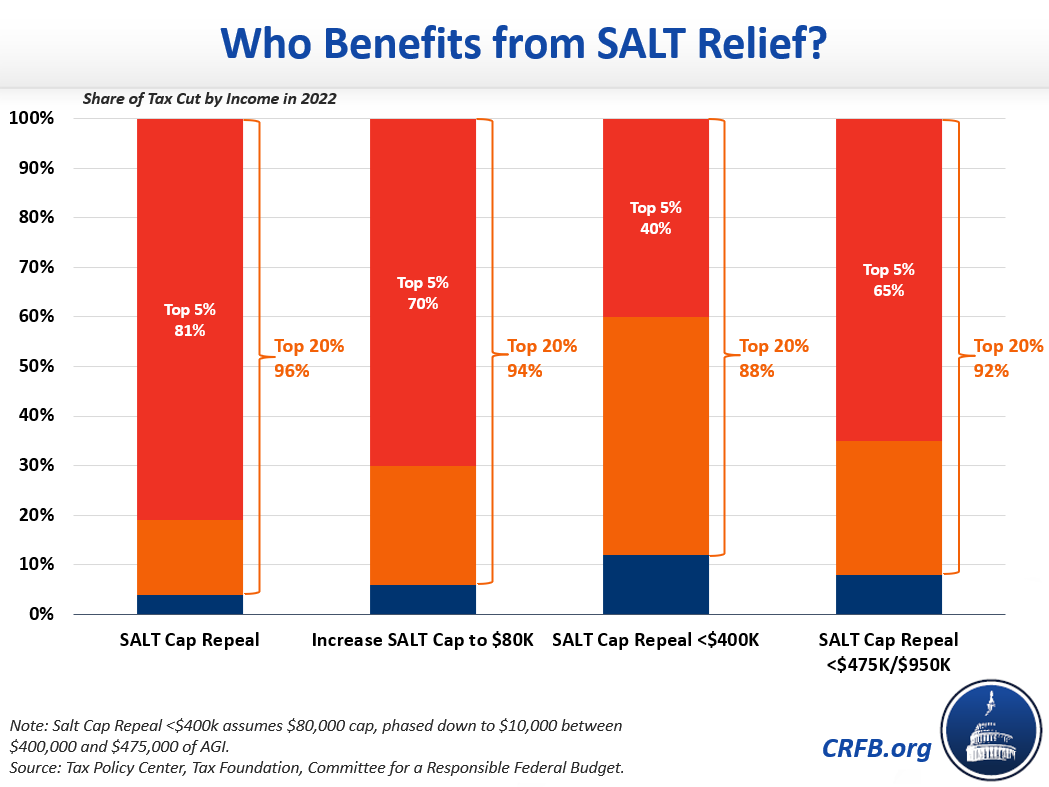

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Pulling the SALT fix out of the legislation also will make it tougher to pass the legislation through the House where last week three Democrats from New York and New Jersey insisted they wont.

. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. The SALT deduction is only available if you itemize your deductions using Schedule A. Preserving the deduction cap or better yet a full repeal of the SALT deduction would result in wealthy residents feeling the full effect of the policies passed by their state and local governments.

We will continue to work with House and Senate leadership to ensure the cap on the SALT deduction is repealed. It could be challenging for lawmakers to get a repeal of the cap included in a relief package this year since Republicans and some centrist Democrats want. This deduction is a below-the-line tax deduction only available to.

Enacted by the Tax. A Democratic proposal aims. Income and resulting tax liability flow through to individual owners members or shareholders.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. The so-called SALT deduction cap which is poised to sunset in 2026 limits the amount of state and local taxes that Americans can deduct from their federal taxes to 10000. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less.

The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize. No SALT no deal. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are.

The change may be significant for filers who itemize deductions in high-tax states and. Democrats are considering including in their social spending package a five-year repeal of the cap on the state and local tax SALT deduction sources told. For those earning less than 500000 per year according to press reports the Senate is likely to take action to repeal the 10000 maximum state and local tax deduction cap.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The SALT deduction allows states and localities to give their high income earners a discount on their taxes.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. What Is The Salt Cap Repeal. The proposal has faced.

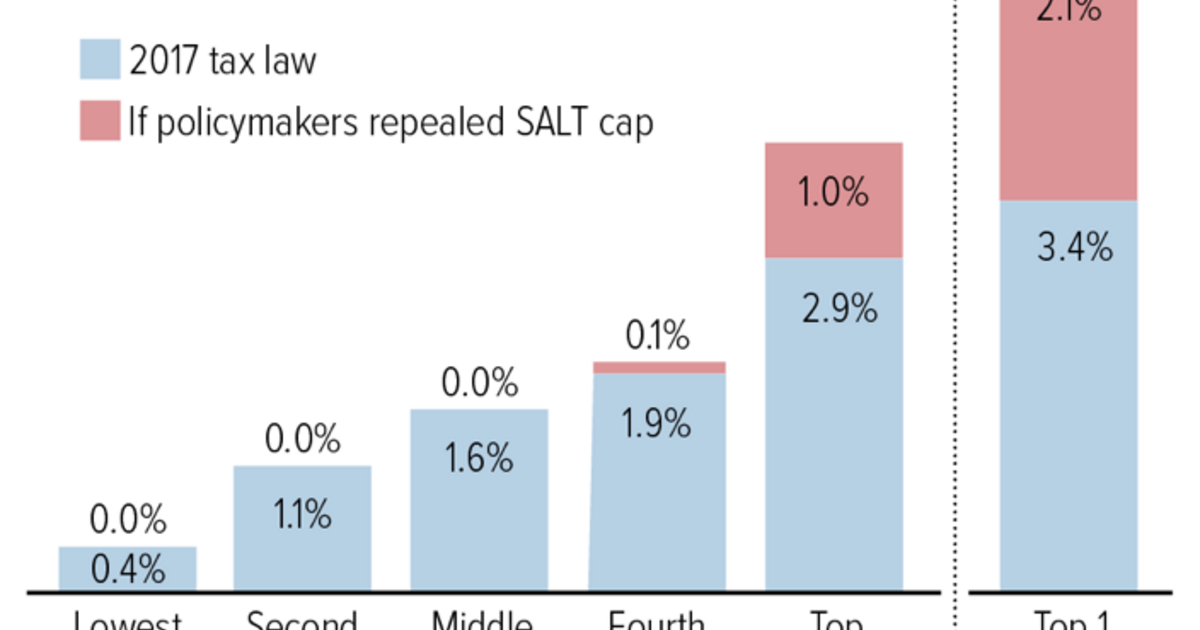

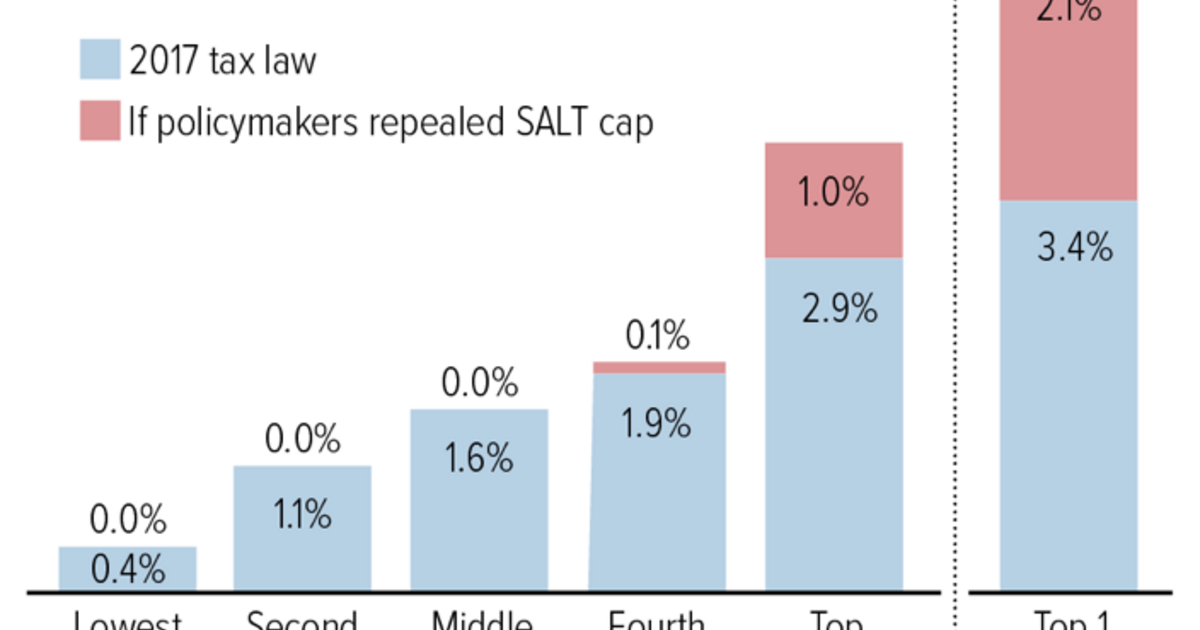

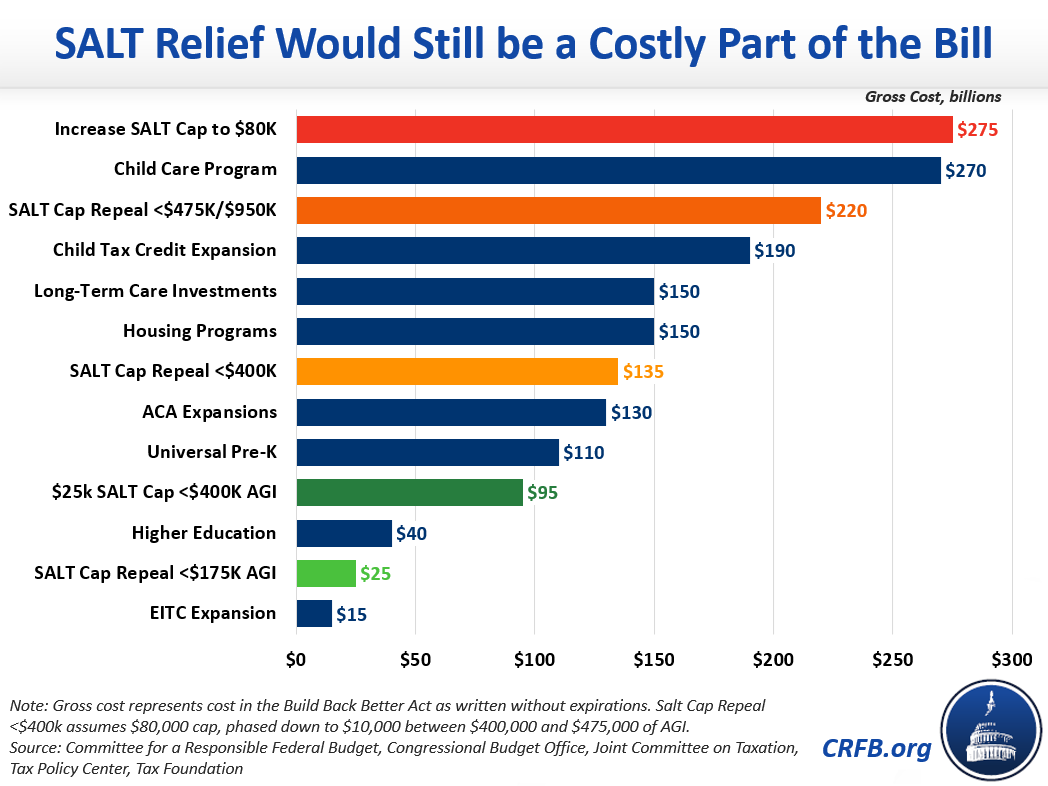

According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better reconciliation package including one retroactive yearAs weve shown before this policy is highly regressive and would turn Build Back Better into a net tax cut for the vast majority of. The deduction of state and local tax payments known as SALT from federal income taxes has been a subject of debate among economists and policymakers over the past few years with significant implications for our budget and fiscal outlook. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

Under the SALT cap owners of pass-through entities may be liable for state and local taxes in every state where their business derives income but may only claim a federal deduction for up to 10000 of all such state-level taxes paid. Under this there would be no cap in place before 2021 and the cap would be lifted to 80000 from 2021 and raised to 10000 in 2031. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

In states that have PTET. It allows those with the most expensive mortgages and by extension the highest incomes to deduct the most reducing their federal taxes by much more than those of the average. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

SALT Cap Repeal TCJA The after-tax income of the top one percent rose by almost 35 percent as a result of the TCJA. No SALT no dice the lawmakers added. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

For the rest of the top quintile it meant a. The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on their taxes.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Dems Somehow Pretend This Mostly Helps The Middle Class The Daily Postercommentsharecommentshare

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Deduction Cap Should Be Reformed Not Repealed Itep

Why Repealing The State And Local Tax Deduction Is So Hard

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget